Housing Analysis

The Slate Belt has experienced minimal population growth over the last ten years, with only a few new small housing developments. However, population projections predict the Slate Belt will experience significant growth over the next 20 years. Accommodating this new population will require new construction, plus repurposing or restoring a large portion of the existing housing stock. Additionally, the Slate Belt communities have had growing concerns about housing attainability, with questions about whether the area has the right mix of housing for its current and future residents.

Plan Slate Belt will need to examine how best to balance growth and preservation—accommodating new people without losing the area’s character and quality of life.

This Housing Analysis examines the current conditions of the housing stock and market in the Slate Belt. The analysis focuses on four main elements: current housing stock, recent construction and renovation, attainability and recent sales. These analyses were based on publicly available data regarding building type, age, occupancy, value and sales from the U.S. Census, Northampton County and the Lehigh Valley Planning Commission. The results were compared to local perceptions about history, attainability and market conditions to draw a better picture of the housing market in the Slate Belt.

Supply and Demand

Current Housing Supply

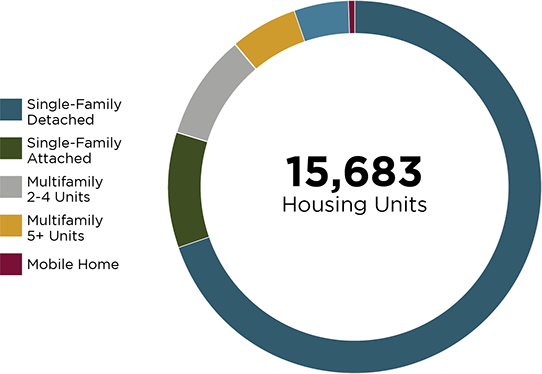

The housing stock in the Slate Belt is dominated by single-family homes. The vast majority of these houses are detached, with a small number of twins, rowhomes, duplexes, apartment buildings and mobile homes. The area has a high percentage of home owners, and the limited number of apartment units means that nearly one-third of the relatively small rental market is made up by single-family homes. Boroughs have a higher percentage of rental housing, with townships having more owner-occupied units.

Overall, the Slate Belt has a vacancy rate of 9%, which is high compared to the Lehigh Valley overall, but not excessive. However, the vacancy rates of individual communities are much higher (Portland Borough 16%) or lower (Lower Mount Bethel Township 2.2%). Some of these rates have fallen while others have risen over the last ten years, with only Upper Mount Bethel Township having consistently high rates. These vacancy rates point to different conditions in individual community’s housing markets and may be reflective of how many properties were for sale at the time, rather than long-term trends that need to be addressed.

More than one-third of the existing housing stock was built prior to 1939. While the Slate Belt saw consistent growth in its housing stock from the 1950’s through the 2000’s, there has been virtually no growth in recent years. Only one major development has been approved, with most of the new housing being in smaller developments or from individual property owners building stand-alone houses.

Building permit data shows the number of renovation projects in 2018 far outpacing new construction. This data shows that some people are making significant investments in their homes.

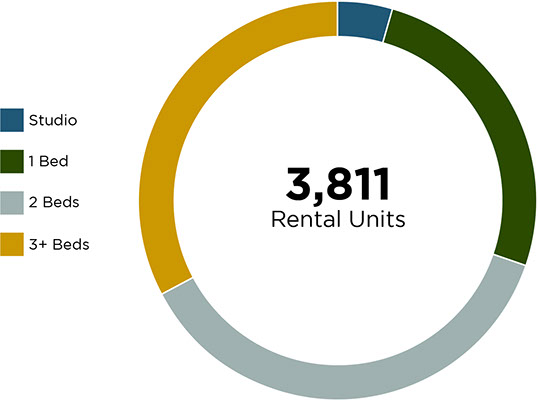

The rental market in the Slate Belt is heavily weighted towards two- and three-bedroom units. Most of these units are priced in the $750-1,500/month price range. This supply works well for families who generally have two incomes. Studio and one-bedroom units make up the bulk of apartments below $750/month, but their supply is much more limited. This could indicate that there is a lack of housing for low- and moderate-income individuals and couples looking for a place they can afford—a common problem for both seniors and young adults in the greater Lehigh Valley.

72%

28%

9%

Owner-Occupied

Renter-Occupied

Vacancy Rate

Building Permits - 2018

25

159

New Residential

Other Residential

Current Housing Demand

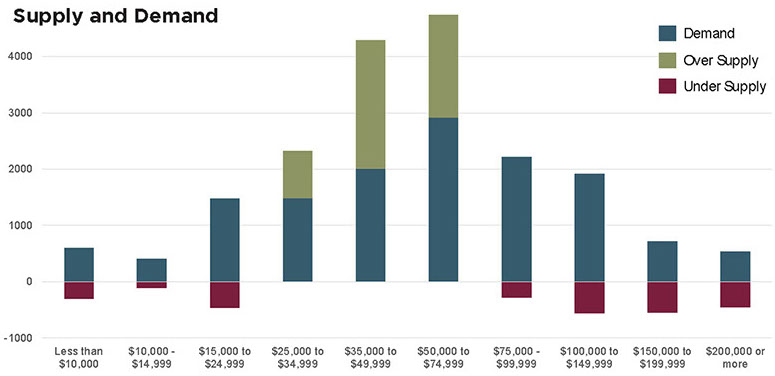

The household income data shows a fairly typical distribution in the Slate Belt, with most households earning just over or under the area’s median income of $63,379. This means that households earning between about $32,000 and $76,000 per year are responsible for most of the housing demand, which makes the majority of the housing supply attainable to those households. However, the lack of housing for people below this threshold means that many lower- and moderate-income households are reaching higher into the housing market to be able to live in the area.

In looking at the percentage of households that are cost-burdened (those who spend more than 30% of their income on housing), we can see how a lack of lower-cost housing is making housing attainability difficult in the area. The limited supply of low-cost housing means that 70% of households making below $35,000 per year are spending more than 30% of their pre-tax income on housing alone. In effect, these households are taking up much of the supply for the next higher-income bracket. This forces people making $35,000-$50,000 per year and those making $50,000-$75,000 per year to reach even higher into the housing market, resulting in a high portion of these middle-class households being cost-burdened.

While relatively few households making over $75,000 are cost-burdened, many of them are also buying into the same middle-income housing market. By purchasing housing below their income potential, this group further restricts the availability of middle-income housing—turning an apparent surplus into a shortage. However, the apparent shortage of high-income housing has not translated into market demand for more expensive homes according to local realtors.

There are several reasons why there may not be as many higher-priced housing units in the Slate Belt. The age of the housing assessment data may be under-representing the true number of these higher-value homes. It may also be that more people in higher-income brackets choose to buy less expensive homes for financial reasons. This could be due to a lack of retail, social and cultural opportunities— an explanation that fits with comments from local realtors.

70%

of households making under $35,000 spend more than 30% of their income on housing. This is also true of ...

40%

making between $35,000-$50,000

31%

making between $50,000 and $75,000

8%

making above

$75,000 per year

Housing Attainability Analysis

Methodology

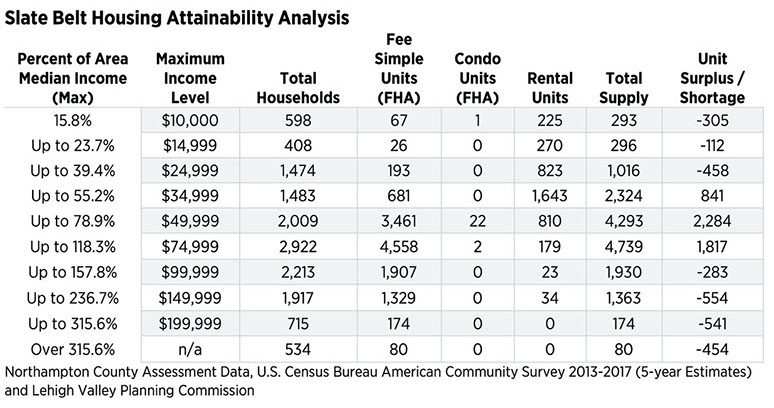

The attainability analysis brings housing supply and demand together in a side-by-side comparison to determine whether there is a surplus or shortage of attainable housing units within each income level.

Property value assessments have not been updated recently and are significantly lower than market value. The assessed value of all properties was converted to a market value price to determine their realistic selling price.

While the model is representative of general housing costs in the Slate Belt, a new county assessment would significantly improve the understanding of current conditions in housing attainability.

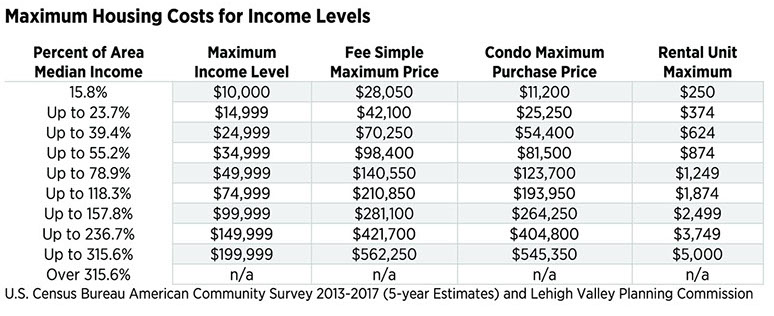

The calculated market values of these existing homes were used to determine the maximum purchase price (not exceeding 30% of pre-tax income) of Fee Simple houses and condos, as well as the maximum rent price, for each income level. For Fee Simple Units and Condominium Units, a Federal Housing Administration (FHA) Mortgage was assumed for a 30-year loan at a rate of 4.6% interest. The factors of the calculation included a down payment, insurance, real estate taxes, and for Condominiums, an annual maintenance fee. Calculations were performed for income ranges expressed as a percentage of $63,379, the median household income for the Slate Belt, referred to as the Area Median Income.

Findings

Housing attainability for households earning below $35,000 and above $50,000 gross annual income is nearly an exact match in households and existing units. The majority of units appropriate for households earning under $35,000 are priced for households earning the upper part of the range between $25,000 and $35,000, indicating that many very low-income households are likely to be cost-burdened. The majority of units appropriate for households earning $50,000 and above are priced for households earning the lower part of the range between $50,000 and $75,000, indicating that many high-income households are likely to “buy down” into lower market levels, resulting in fewer housing options for lower-middle income households earning between $35,000 and $50,000.

Housing Market

Slate Belt Trends

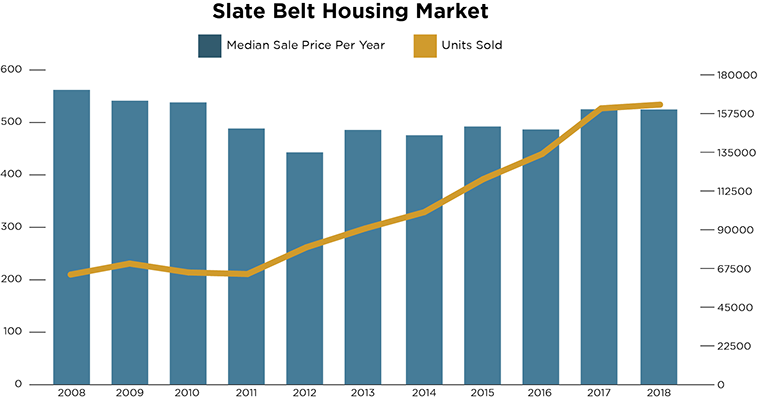

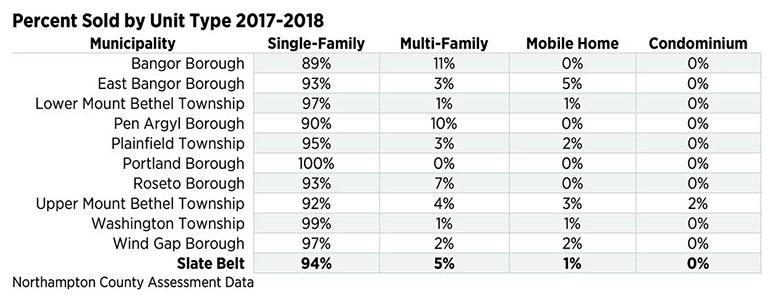

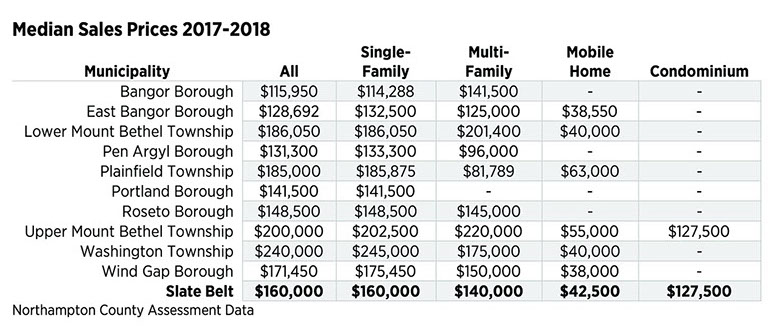

Single-family housing has dominated recent sales in the Slate Belt. The median price for these sales has been squarely in line with the peak supply and demand for the area, at $160,000. This median sales price lines up nicely with the median household income and would be considered attainable. This alignment indicates housing sales prices are generally in line with what people are able to pay in the Slate Belt, although the more specific analysis by income range indicates attainability challenges for households earning $24,999 or less.

Overall sales have been steadily climbing since the recession, showing healthy demand within the Slate Belt. Housing values, however, have only recently come close to their pre-recession levels.

Municipal Trends

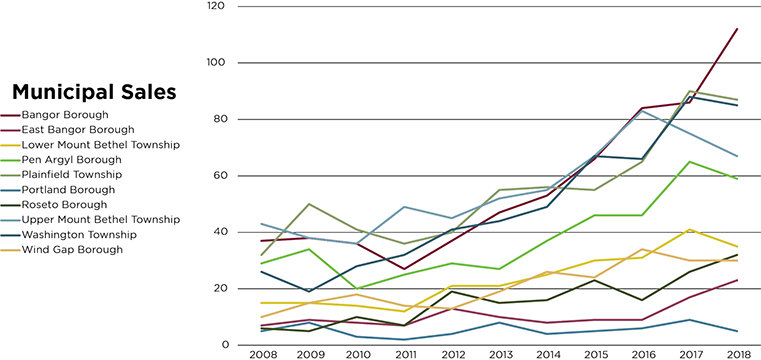

Individual municipalities have also seen a similar upward trend in sales volume over the last ten years. Bangor Borough and Plainfield and Washington townships have seen the most significant increase in sales, with more modest growth in East Bangor, Wind Gap and Roseto boroughs. Portland Borough is the only community to have a nearly consistent number of sales per year, which is likely due to its small size and limited housing stock.

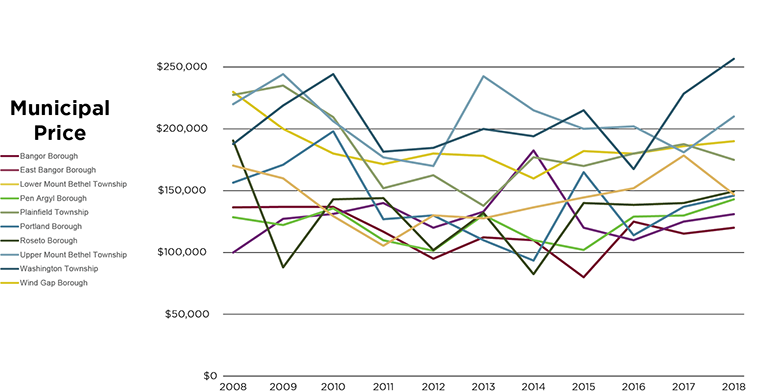

Median sales values have been less predictable on the municipal level. While the overall area experienced a post-recession decline and resurgence, individual communities have risen and fallen significantly year to year. This lack of a pattern is likely due to each community’s individual housing markets being relatively small so that their median sales value is more connected to which specific properties changed hands in a given year.

Current Conditions

While the housing market for the Slate Belt overall is dominated by single-family homes, multi-family homes make up a larger percentage of the housing sales in the boroughs. This is likely due to an older and more diverse housing stock.

Median sales prices also vary significantly between individual municipalities. Bangor Borough has the lowest median sales price across each housing type. Washington Township has the highest median sales price for a single-family home, while Upper Mount Bethel Township has the highest median sales price for multi-family housing and condominiums. Plainfield Township has the highest median sales price for mobile homes.

Several of the municipalities, including Bangor Borough, Lower Mount Bethel Township and Upper Mount Bethel Township have higher median sales prices for multi-family housing than for single-family. While this may seem unusual, it is quite common in areas with strong demand for rental housing, as the extra income from the additional units can help pay for a higher mortgage. Significantly higher sales values of multi-family housing often indicate that rental prices are relatively high, demonstrating a greater demand for rental housing in the community.

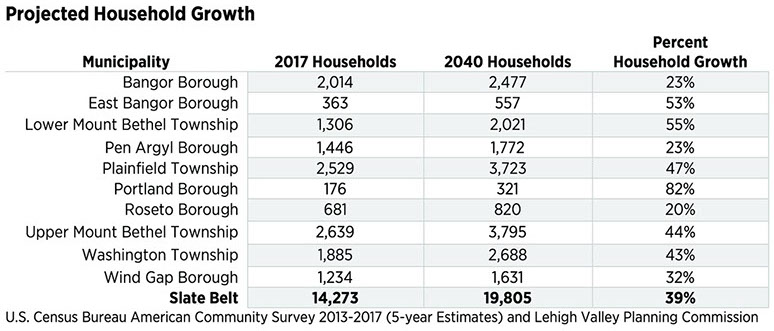

Future Housing Demand

The Slate Belt saw virtually no population growth over the last decade. However, population projections show that the area will experience a significant population increase over the next twenty years. This increase is due to overall growth within the Lehigh Valley and less potentially developable land in areas that have accommodated growth over the last several decades.

This new population will require significant amounts of new housing in the Slate Belt. Using the current household formation rates (how many people per household on average) for each municipality, the Slate Belt is estimated to need 5,532 new housing units by 2040—nearly a 40% increase over the current housing stock. To meet that need, the area would need to add about 285 new homes per year for the next twenty years—a significant increase from recent development trends.

Summary

The Slate Belt has not seen significant growth or development in the last ten years. Lately, however, the median sales price and total number of sales have been on the rise—indicating a return to pre-recession demands. Population projections indicate that some communities could see their population increase significantly in the next 20 years. This growth will present challenges in preserving the region’s rural character, but also opportunities that may enable Slate Belt leaders to shape the future they want.

At the same time, housing attainability is being pinched. Low-income households are having to stretch to meet their housing needs, while higher-income households are choosing to buy from the existing pool of middle-income housing, rather than build new or buy extensively renovated properties. This upward and downward reach is making it harder for middle-income households to find housing, despite much of the stock being valued in alignment with their income levels.

Older and aging housing stock that has not been well-maintained over the decades will require revitalization strategies to remain, or be brought to, good condition. Areas of distressed housing markets within the boroughs will require greater public and private investments to prevent further squeezing of housing at lower price points.

Determining the best way to accommodate this population and housing growth, where to put it and what kinds of housing will be needed will be key to balancing growth and preservation, as well as maintaining the quality of life for the Slate Belt.

Consultant, site maintained by Lehigh Valley Planning Commission